5 Factors that Impact Your Credit Score in Canada

Not all debt is created equal on a credit report. Lenders consider credit rating, payment history, amounts owed, length of credit history, new credit and the types of credit in use before approving an applicant for financing. Effectively managing these 5 factors and understanding how they can impact your credit score will increase your chance of getting approved for financing at the best rate available.

Recently Canada Drives uncovered a lot of talk about what is good debt and what is bad debt. Here’s the truth: no debt is bad debt if you manage it responsibly. By making payments on-time and understanding the different factors that can impact a credit score, you’ll be more likely to get approved for financing with the best rates available in Canada.

If you’re not sure what your credit score is, the folks at Borrowell will tell you what it is - and it’s free!

Types of Debt

Before we get into the factors that impact credit, it’s important to know what kinds of debt exist and how they differ:

- Revolving Credit: Any credit that is paid down and becomes available to you again, a line of credit or credit card, is referred to as revolving credit. When a bank or a financial institution lends you a specific amount of money for revolving credit, the account remains accessible to you as you continually pay off and re-spend. Having more than one revolving credit account, alongside installment credit, will show great diversity on your report.

- Installment Credit: This kind of credit is any debt that is paid off by the borrower over a period. The lump sum of money that you borrow will have a fixed rate and will be paid off monthly to the creditor. Examples of installment credit are auto financing, mortgages and student loans. Unlike revolving credit, this kind of debt is a one-time borrow; once it’s paid off, you can’t re-borrow from the same pot.

Things That Affect Your Credit Score:

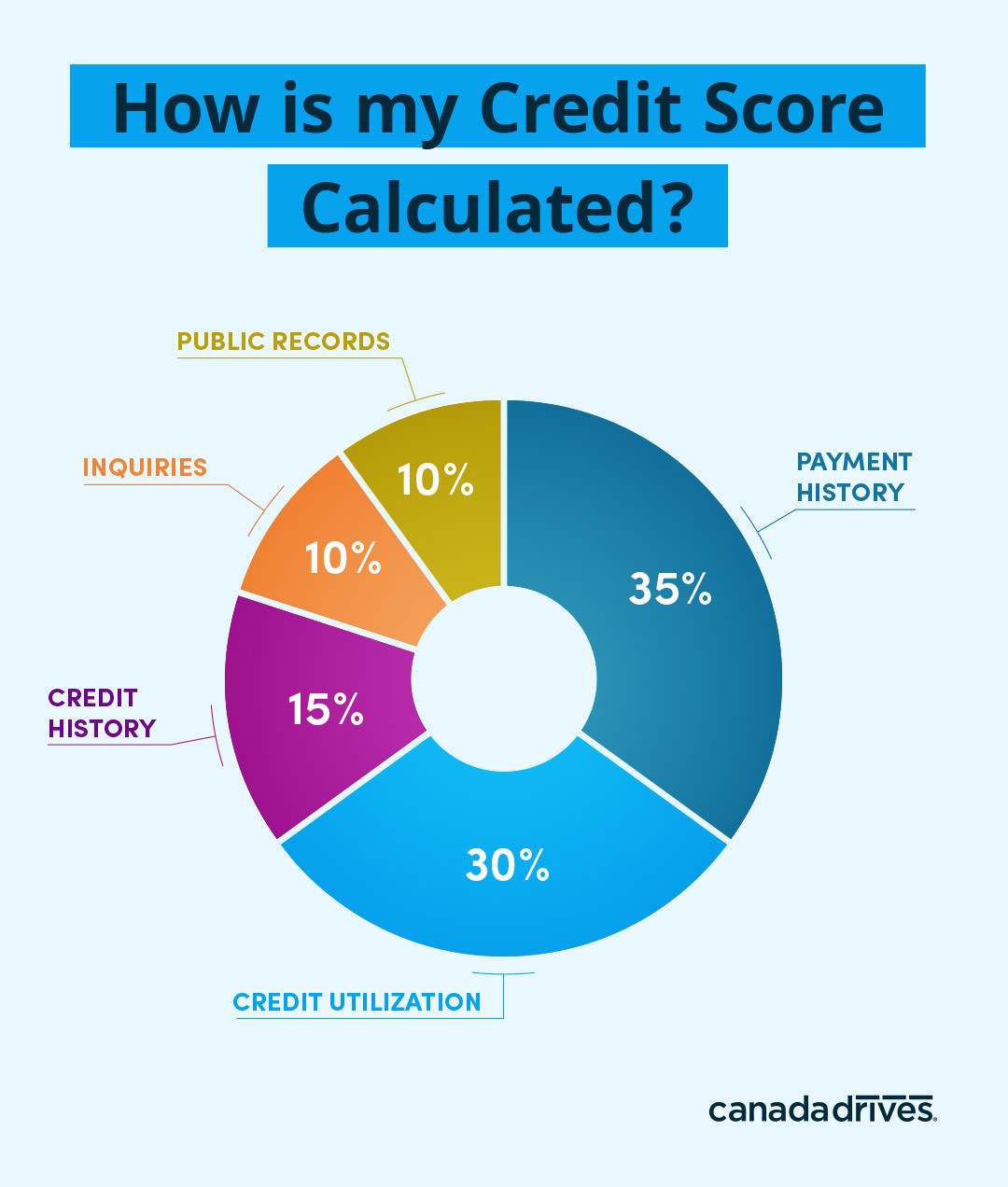

These different forms of credit are available to Canadians, but most people aren’t familiar with the factors that influence how revolving and installment is calculated. How much debt you have, how much debt you spend, how frequently you pay back debt, if you have any hard credit checks or derogatory marks from collection agencies – the list of things that your credit score relies on is heavy. Breaking down the credit equation can help you better understand how bureaus determine your credit score:

- Payment History - 35% of your score

- Credit Utilization - 30% of your score

- Length of Credit History - 15% of your score

- New Credit - 10% of your score

- Types of Credit in Use - 10% of your score

1. Payment History (35%)

One of the most important factors that lenders consider before a borrower can be approved for financing is their payment history. One-third of a credit score is determined by payment history, so few late payments won’t drastically drop a credit score, however multiple late payments on a credit report could. Late payments stay on a report for seven years, but luckily, recovering your score by paying back debt quickly can help you rebound from credit delinquency fast.

2. Credit Utilization (30%)

If you have a lot of debt, it doesn’t necessarily mean that you’re a high-risk borrower. However, using a high percentage of available credit funds is a factor that lenders consider, as the chances of missing a payment for a borrower who frequently owes a lot might be high. If you have multiple credit accounts that are consistently maxed out, your chances of being approved for financing with reasonable rates won’t be as high compared to an applicant who manages to pay down their debt in full each month.

3. Length of Credit History (15%)

“In the credit scoring world, age and experience trump youth and enthusiasm,” - creditcards.com. You don’t need to be a veteran to have a great credit score, but the longer a credit account is open the better. The length of credit accounts matters to lenders because it shows how much experience you have managing and paying off debt. The longer the credit history, the more accurate lenders can determine how much of a risk you are when lending to you. Closed accounts will stay on a credit report from 7-10 years.

4. New Credit (10%)

When applying for financing, lenders will look at the amount of new credit an applicant has. This factor is important to lenders, as it lets them see how you typically shop for credit. Research suggests that applying for a lot of new financing in a short period of time can drop your score. By doing so, your average account age will lower and affect your length of credit history, which will impact your overall credit score and how lenders view you.

5. Types of Credit in Use (10%)

Do you have experience with multiple forms of credit? Credit mix accounts for 10 percent of your overall credit score calculation. Having more than one type of credit account on your file, while managing them all responsibly, will have a positive effect on your score and will be evidence to creditors that you can successfully borrow from both kinds of credit. Canadians with mixed credit accounts on their report tend to have higher scores compared to people who only have one or the other. Balancing between installment and revolving credit will guarantee you a raise in your credit score.

The Final Word...

Good debt means being a wise borrower. In our opinion, all debt should be managed wisely. The best thing you can do for yourself before applying for financing is to decide carefully how your financial choices today will impact your financial choices in the future.

If you want to check your credit score, download your free credit report at Borrowell.